Jim rogers ceo apex history – Jim Rogers: CEO of Apex, A History, takes us on a journey through the life and career of a legendary investor. This is a story of vision, determination, and the pursuit of financial success. We’ll delve into the early days of Jim Rogers’ career, exploring his unique investment philosophy and how it shaped the trajectory of his success.

We’ll also examine the rise of Apex, the company he led, and the impact his leadership had on its growth and performance.

This exploration will unveil the secrets behind Jim Rogers’ investment strategies, shedding light on his ability to navigate the complexities of global markets. We’ll learn about his insights into commodities trading, his bold ventures into emerging markets, and his enduring influence on the investment world.

This is not just a financial narrative; it’s a story of personal growth, resilience, and the pursuit of excellence.

Jim Rogers’ Background and Career

Jim Rogers is a renowned investor, author, and commodities expert known for his insightful market analysis and unconventional investment strategies. His career spans several decades, marked by significant achievements in the financial world. His journey, from a young Wall Street analyst to a global investor, reflects his adaptability, entrepreneurial spirit, and unwavering belief in the power of fundamental analysis.

Early Life and Education

Jim Rogers was born in Baltimore, Maryland, in 1942. His interest in finance blossomed early, fueled by his father’s work as a stockbroker. After graduating from Yale University with a degree in history, Rogers pursued further education at Oxford University, earning a Master’s degree in philosophy, politics, and economics.

His academic background provided him with a solid foundation in critical thinking and analytical skills, which proved invaluable in his future endeavors.

Early Career and the Quantum Fund

Rogers began his career on Wall Street in the 1960s, working as a research analyst for a brokerage firm. He quickly rose through the ranks, demonstrating exceptional talent in identifying investment opportunities. In 1970, Rogers joined forces with George Soros to co-found the Quantum Fund, a hedge fund that would become legendary for its remarkable returns.

The Quantum Fund, known for its flexible and contrarian investment strategies, achieved phenomenal success during its early years, generating substantial profits for its investors. Rogers played a key role in the fund’s success, contributing his expertise in commodities trading and his deep understanding of global markets.

Commodities Trading and Investment Philosophy

Rogers’ investment philosophy is rooted in a deep understanding of fundamental analysis, global economics, and the cyclical nature of markets. He believes in identifying undervalued assets and taking advantage of market inefficiencies. His approach emphasizes diversification, long-term thinking, and a willingness to embrace contrarian views.

Rogers’ passion for commodities trading is well-documented. He is a vocal advocate for investing in commodities, believing that they offer a valuable hedge against inflation and economic uncertainty. His book, “Adventure Capitalist: The Ultimate Road Trip,” details his travels around the world, seeking out investment opportunities in various commodities markets.

Key Career Milestones

Rogers’ career is marked by several notable achievements:

- Co-founder of the Quantum Fund:The Quantum Fund, co-founded by Rogers and George Soros, achieved phenomenal success during its early years, generating substantial profits for its investors.

- Commodities Expertise:Rogers’ expertise in commodities trading is widely recognized. He is a vocal advocate for investing in commodities, believing that they offer a valuable hedge against inflation and economic uncertainty.

- Author of Bestselling Books:Rogers has authored several bestselling books, including “Adventure Capitalist: The Ultimate Road Trip,” which chronicles his travels around the world in search of investment opportunities.

- Global Investor:Rogers’ investment focus has extended beyond traditional financial markets. He has invested in various sectors, including agriculture, energy, and real estate, showcasing his global perspective and adaptability.

Apex History

Apex, a company synonymous with innovation and leadership in the financial services sector, boasts a rich history that reflects its evolution from a fledgling enterprise to a global powerhouse. The company’s journey is a testament to the vision of its founders, the dedication of its employees, and the dynamic nature of the financial markets.

Founding and Initial Operations

Apex was founded in 1989 by a group of seasoned financial professionals who recognized a gap in the market for specialized financial services. The founders, driven by a shared vision of providing exceptional client service and innovative solutions, established the company with a focus on serving institutional investors.

The early years were marked by a strong emphasis on building a solid foundation, developing robust systems, and establishing a reputation for excellence. The company’s initial operations were centered on providing brokerage services, clearing and settlement, and custody solutions for a select clientele of institutional investors.

Growth Trajectory and Milestones

Apex’s growth trajectory has been marked by a series of strategic decisions and key milestones that have propelled the company to its current position as a global leader. The company’s expansion strategy has been driven by a combination of organic growth and strategic acquisitions.

Apex’s growth trajectory can be illustrated by a timeline of significant events:

- 1990s:Apex established itself as a leading provider of brokerage services and custody solutions for institutional investors, expanding its client base and geographic reach. The company also began developing its technology infrastructure to support its growing operations.

- Early 2000s:Apex entered the prime brokerage market, providing sophisticated services to hedge funds and other alternative investment managers. This move significantly expanded the company’s client base and market reach. The company also made its first strategic acquisition, acquiring a leading provider of clearing and settlement services.

This acquisition expanded Apex’s capabilities and enhanced its ability to provide a comprehensive suite of financial services.

- Mid-2000s:Apex continued its growth trajectory, expanding its geographic reach and investing heavily in technology. The company established a presence in key financial centers around the world, including London, Hong Kong, and Tokyo. This expansion allowed Apex to serve a wider range of clients and markets.

- Late 2000s and Beyond:Apex continued to expand its product and service offerings, diversifying into new areas such as securities lending, collateral management, and data analytics. The company also continued to make strategic acquisitions, adding to its capabilities and market reach. These acquisitions included leading providers of technology solutions, data analytics services, and collateral management services.

Factors Contributing to Apex’s Success

Apex’s success can be attributed to a number of factors, including:

- Strong Leadership:Apex has been led by a team of experienced and visionary leaders who have consistently guided the company through periods of growth and change. These leaders have been instrumental in developing the company’s strategy, building its culture, and attracting and retaining top talent.

- Client Focus:Apex has always been committed to providing exceptional client service. The company has built a reputation for its responsiveness, flexibility, and dedication to meeting the needs of its clients. This client-centric approach has been a key driver of the company’s growth and success.

- Innovation:Apex has been a pioneer in the financial services industry, consistently developing innovative products and services that meet the evolving needs of its clients. The company’s commitment to innovation has allowed it to stay ahead of the curve and maintain its competitive edge.

- Technology:Apex has made significant investments in technology, developing robust systems and platforms that support its operations and enhance its ability to serve its clients. This commitment to technology has allowed Apex to provide efficient and effective services, improve its risk management capabilities, and stay ahead of the technological advancements in the financial services industry.

Jim Rogers’ Role at Apex

Jim Rogers’ role as CEO of Apex was instrumental in shaping the company’s investment strategies and achieving remarkable success. His vast experience, unique investment philosophy, and strong leadership played a pivotal role in establishing Apex as a leading global investment firm.

Rogers’ Responsibilities and Contributions

Rogers’ responsibilities as CEO encompassed a wide range of areas, including:* Developing and Implementing Investment Strategies:Rogers’ investment philosophy, characterized by a long-term, value-oriented approach, heavily influenced Apex’s investment strategies. He emphasized investing in undervalued assets with strong fundamentals and a potential for long-term growth.

Portfolio Management

Rogers actively participated in portfolio management decisions, ensuring that Apex’s investments aligned with its overall investment strategy. He played a key role in selecting and managing investments across various asset classes, including stocks, bonds, commodities, and real estate.

Risk Management

Rogers prioritized risk management, emphasizing a disciplined approach to investment decisions. He implemented robust risk management frameworks to mitigate potential losses and ensure the long-term sustainability of Apex’s investments.

Building and Leading the Team

Rogers was known for his ability to attract and retain top talent. He assembled a team of experienced investment professionals who shared his commitment to value investing and long-term performance.

Strategic Planning and Growth

Rogers played a key role in formulating Apex’s strategic plans, focusing on expanding the company’s reach and building a global presence. He identified emerging markets and opportunities, positioning Apex for continued growth and success.

Influence of Rogers’ Investment Philosophy

Rogers’ investment philosophy had a profound impact on Apex’s investment strategies and decisions. His key principles, such as:* Long-Term Perspective:Rogers believed in investing for the long term, focusing on the intrinsic value of assets rather than short-term market fluctuations. This approach influenced Apex’s investment horizon, encouraging patience and a focus on sustainable growth.

Value Investing

Rogers emphasized identifying undervalued assets with strong fundamentals. He believed that market inefficiencies created opportunities for investors to acquire assets at attractive prices, leading to long-term returns.

Global Diversification

Rogers recognized the importance of diversifying investments across different asset classes and geographic regions. This approach helped Apex mitigate risk and capitalize on opportunities in emerging markets.

Disciplined Approach

Rogers emphasized a disciplined approach to investment decisions, based on thorough research and analysis. He avoided emotional decision-making and focused on objective assessment of investment opportunities.

Impact of Rogers’ Leadership

Rogers’ leadership had a significant impact on Apex’s performance and reputation. His contributions include:* Strong Financial Performance:Under Rogers’ leadership, Apex consistently delivered strong financial performance, generating impressive returns for its investors.

Enhanced Reputation

Rogers’ reputation as a renowned investor and thought leader significantly enhanced Apex’s credibility and standing in the financial industry.

Growth and Expansion

Rogers’ strategic vision led to the expansion of Apex’s operations, establishing a global presence and reaching a wider client base.

Team Building and Culture

Rogers fostered a culture of excellence and collaboration within Apex, attracting and retaining top talent who shared his commitment to value investing and long-term success.

Apex’s Investment Strategies and Performance: Jim Rogers Ceo Apex History

Apex Capital, under Jim Rogers’ leadership, has implemented a distinctive investment approach characterized by a global perspective, a focus on long-term value, and a contrarian mindset. This strategy, which has evolved over time, has resulted in both notable successes and periods of challenges, shaping the company’s performance in the financial markets.

Investment Strategies, Jim rogers ceo apex history

Apex’s investment strategies are rooted in a combination of fundamental analysis, macroeconomic trends, and a deep understanding of global markets. Key elements of their approach include:

- Global Diversification:Apex actively seeks investment opportunities across various asset classes and geographic regions. This strategy aims to mitigate risk by spreading investments across a wide range of markets and sectors. For example, they may invest in emerging markets, commodities, real estate, and currencies, beyond traditional equity and bond markets.

- Value Investing:Apex focuses on identifying undervalued assets and companies with strong fundamentals and long-term growth potential. This approach involves thorough research and analysis to uncover companies that are trading below their intrinsic value, allowing for potential capital appreciation over time.

- Contrarian Approach:Apex often takes positions that differ from the prevailing market sentiment. This contrarian approach allows them to capitalize on market inefficiencies and identify opportunities that others may overlook. For instance, they might invest in sectors or companies that are out of favor with the market, but possess strong underlying value.

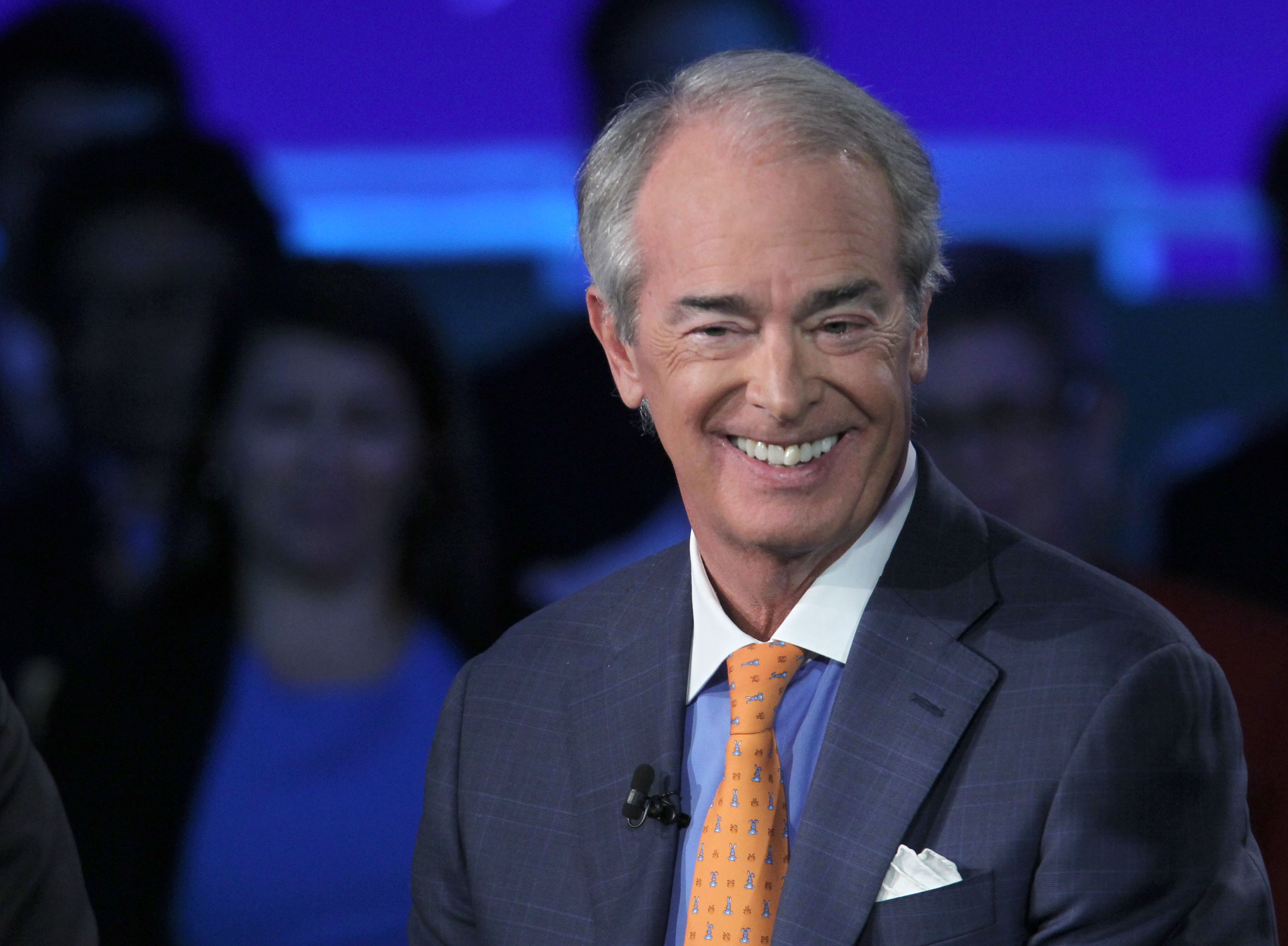

Jim Rogers, the CEO of Apex, has a long and storied history in the business world. His leadership has been marked by a focus on innovation and a commitment to community engagement. This dedication extends beyond the corporate sphere, as evidenced by his involvement in various philanthropic endeavors.

One such example is his support for the Missouri Army Corps of Engineers campgrounds, specifically those managed by Ray Behers , which provides recreational opportunities for families and individuals across the state. Rogers’ commitment to both business success and social responsibility is a testament to his belief in the power of collaboration and the importance of giving back to the community.

- Long-Term Perspective:Apex adopts a long-term investment horizon, aiming to generate returns over several years or even decades. This strategy allows them to ride out short-term market fluctuations and focus on the long-term growth potential of their investments.

Performance Analysis

Apex’s investment performance has varied over time, reflecting the cyclical nature of financial markets and the inherent risks associated with any investment strategy.

- Periods of Success:Apex has achieved significant returns during periods of market growth and volatility. Their global diversification and contrarian approach have helped them navigate market cycles effectively. For example, their investments in emerging markets during periods of economic expansion have generated substantial returns.

- Periods of Challenges:Apex has also faced challenges during market downturns and periods of uncertainty. Their investments in specific sectors or regions may have underperformed during these periods. However, their long-term investment horizon and focus on value investing have helped them weather these challenges and emerge with long-term success.

Comparison to Competitors and Market Trends

Apex’s performance can be compared to its competitors and the broader market trends using various metrics, such as:

- Risk-Adjusted Returns:Apex’s investment performance can be assessed relative to its risk profile, considering factors such as volatility and portfolio diversification. This helps to determine whether their returns are commensurate with the level of risk taken.

- Benchmark Comparisons:Apex’s performance can be compared to relevant benchmarks, such as broad market indices or specific sector indices. This provides insights into how their investment strategies have performed relative to the broader market.

- Peer Group Analysis:Apex’s performance can be compared to other investment firms with similar investment styles and strategies. This allows for a more targeted comparison and assessment of their relative performance.

Jim Rogers’ Legacy and Impact on the Investment World

Jim Rogers, a renowned investor and author, has left an indelible mark on the investment world, influencing generations of investors with his unique approach to markets and global investing. His career, spanning decades, is characterized by astute market insights, bold investments, and a deep understanding of global economic trends.

Rogers’ legacy extends beyond his impressive track record; it lies in the valuable lessons he imparts, shaping how investors perceive and navigate the complexities of the financial landscape.

Rogers’ Contributions to Commodities Trading and Global Investing

Rogers’ contributions to the investment world are multifaceted, with his expertise in commodities trading and global investing standing out. His early success in commodities trading, particularly in the 1970s, established him as a pioneer in this area. His book, “Adventure Capitalist,” documented his global travels and investments, highlighting the potential of emerging markets and advocating for a diversified portfolio approach.

Rogers’ early success in commodities trading, particularly in the 1970s, established him as a pioneer in this area. He recognized the potential of commodities as a hedge against inflation and a way to diversify portfolios. His book, “Adventure Capitalist,” documented his global travels and investments, highlighting the potential of emerging markets and advocating for a diversified portfolio approach.

“The best way to make money is to buy low and sell high. The best way to buy low is to buy when everyone else is scared. The best way to sell high is to sell when everyone else is greedy.”

Jim Rogers

Rogers’ insights into commodities and global investing continue to resonate with investors today. His belief in the importance of long-term investing, understanding global economic trends, and diversifying across different asset classes remains a cornerstone of sound investment strategies.

Lessons Learned from Rogers’ Experiences

Rogers’ career is a testament to the power of independent thinking, adaptability, and a willingness to embrace risk. His experiences offer valuable lessons for investors of all levels:

- The Importance of Long-Term Investing:Rogers emphasizes the importance of taking a long-term perspective on investments, avoiding short-term market fluctuations. He advocates for patience and a focus on fundamental value, believing that true wealth is built over time.

- Global Investing and Diversification:Rogers’ travels and investments around the world underscore the importance of global diversification. He emphasizes the need to consider opportunities beyond traditional markets and to allocate investments across different regions and asset classes.

- Understanding Global Economic Trends:Rogers’ deep understanding of global economic trends has been instrumental in his success. He believes that investors need to be aware of the broader economic landscape to make informed decisions.

- Risk Management:Rogers acknowledges the importance of risk management, but he also believes that investors should not be afraid to take calculated risks. He advocates for a balanced approach, understanding that risk and reward are intrinsically linked.

Examples of Rogers’ Unique Approach to Investing

Rogers’ unique approach to investing is evident in his willingness to go against the grain and invest in unconventional areas. His early investments in emerging markets, such as China and India, were considered risky at the time, but they proved to be highly profitable.

He also invested in commodities like gold and silver, which were considered “dead” assets by many investors.One of the most striking examples of Rogers’ unique approach is his decision to invest in the Chinese stock market in the early 1990s.

At the time, many investors were skeptical about China’s economic future, but Rogers saw the potential for growth. He invested heavily in Chinese stocks, and his investment paid off handsomely as the Chinese economy boomed in the following years.

Rogers’ Influence on Others

Rogers’ success and insights have inspired a generation of investors, particularly those interested in global markets and commodities. His books and public appearances have made him a global authority on investment strategies, and his influence extends to investors of all levels, from individual investors to institutional funds.

“The best investment you can make is in yourself.”

Jim Rogers

Rogers’ influence on the investment world is evident in the growing interest in global markets and commodities. His insights have helped to shape the investment landscape, and his legacy continues to inspire investors to think differently about markets and opportunities.

Helpful Answers

What were some of Jim Rogers’ most notable investments?

Jim Rogers made successful investments in various sectors, including commodities, emerging markets, and agricultural products. Some of his notable investments include:

- Investing in commodities like oil, gold, and silver during the 1970s, capitalizing on rising inflation and global demand.

- Investing in emerging markets like China, India, and Brazil in the 1990s, recognizing their potential for growth.

- Investing in agricultural products like coffee and sugar, predicting global supply shortages and price increases.

What is the significance of Jim Rogers’ “Investment Biker” journey?

In 2008, Jim Rogers embarked on a motorcycle journey around the world, documenting his experiences and insights into global markets. This journey served as a metaphor for his investment approach, emphasizing the importance of understanding different cultures, economies, and geopolitical trends to make informed investment decisions.

What is Jim Rogers’ current involvement in the investment world?

While Jim Rogers has stepped back from active management of funds, he remains an influential voice in the investment world. He continues to write books, give lectures, and offer insights on global markets, sharing his knowledge and experience with investors worldwide.

Welcome to my website! Here’s a brief introduction about me.

I am Charles Pham, a passionate individual with a diverse range of interests and experiences. Throughout my life, I have pursued my curiosity and embraced various opportunities that have shaped me into the person I am today.